How Does a Job-costing System Differ From a Process-costing System

Job order costing and process costing. In this section I will now gather everything we have seen together into a synthetic example illustrating all the steps of the costing process and putting side by side the different methods.

Comparison Of Job Costing With Process Costing Managerial Accounting Cost Accounting Accounting Education

Organization of Flow of Goods through Production.

. 117 source document p. A business operates a job costing system and has the aim of making a net profit of 30 on sales. The main differences between job order costing and process costing are given below.

Job order costing is a costing method which is used to determine the cost of manufacturing each product. Record Keeping Much more record keeping is required for job costing since time and materials must be charged to specific jobs. A job-costing system assigns costs to masses of similar units.

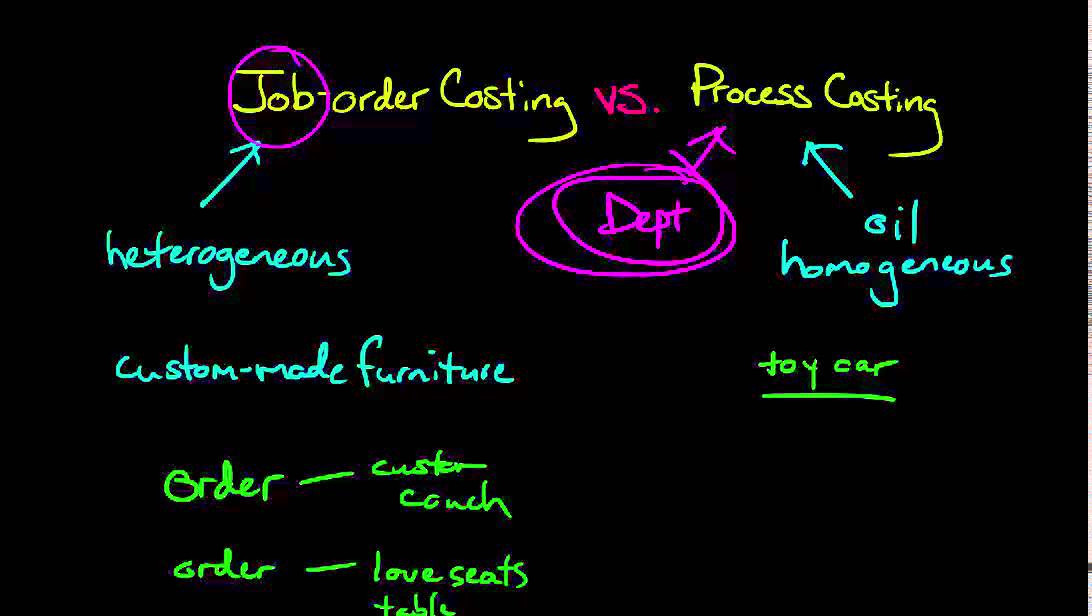

Here are some ways job costing and process costing differ. Differences Between Job Costing and Process Costing. How does a job-costing system differ from a process-costing system.

In job costing production is customized while it is standardized in process costing. Job order costing as per the name involves costing for individual job orders. How does a job-costing system differ from a process-costing system.

These units or products are not individualized for the customer or event. However a company that. A job-costing system assigns costs to distinct units.

Typically job costing offers fewer opportunities for cost reduction while process costing offers companies various opportunities for cost reduction. The correct answer is B. Job order costing assigns costs to specific units or products.

A process-costing system assigns costs to distinct units. Regardless of the costing method used job order costing process costing or another method manufacturing companies are generally similar in their organizational structure and have a similar flow of goods through productionThe diagram in Figure 42 shows a partial organizational chart for sign manufacturer Dinosaur Vinyl. In job costing it is calculating the cost of each job.

Overallocated indirect costs p. A process-costing system does not allocate indirect costs to products. This means that for every job completed by a factory direct costs material labor can be directly attributable to each individual job.

A hybrid costing system is a cost accounting system that includes features of both a job costing and process costing system. Step 1 Identify the job that is the chosen cost object. The assignment of direct materials and direct labor to each production unit illustrates the job order costing systems focus on prime costs in contrast to the process costing system which assigns costs to the department and focuses on direct materials and conversion costs which are composed of a combination of direct labor and overhead.

In a manufacturing environment job cost accounting systems and process cost accounting systems differ in the way. In case of the Job Costing costs of the customized or the special contract is calculated where the work is done according to the instructions of the specific client of the company whereas in case of the Process costing the cost charged to a different process of the company is determined. A company that produces custom items or small batches of items may benefit more from using job costing.

In job costing it is calculating the cost of each job. So lets pass it up job costing system right. Job-costing systems are used in organizations where production is of low mass the process process is discontinuous for heterogeneous products.

Direct materials 80kg at 5 per kg View Answer. This is because job costing allows managers to track and assess how a company allocates and uses their resources for each part of a specific project. A job-costing system assigns costs to masses of similar units.

So casts assigned two distinct. Difference Between Job Costing and Process Costing. Step 2 Identify the direct costs of the job.

In process costing the cost is first determined by the process and then decided based on the number of units produced. There are two traditional costing methods that companies use to assign costs to the products andor services that they provide. Process costing aggregates costs and so requires less record keeping.

Job costing is used for very small production runs and process costing is used for large production runs. How does a job-costing system differ from a process-costing system. So uh we will discuss the difference between job casting system and process casting system.

Work in progress Work in progress WIP refers to the costs of incomplete products including materials and labor. How does a job costing system help a company evaluate the profitability of jobs. Many companies do not realize that they are using a hybrid costing system - they have simply adapted their cost accounting systems to the operational requirements of their business models.

In process costing the cost is first determined by the process and then decided based on the number of units produced. Process costing is a type of operation costing which is used to ascertain the cost of a product at each process or stage of manufacture. This per-unit cost is the average unit cost that applies to each of the.

In each period process-costing system divide the total costs of producing an identical or similar product or service by the total number of units produced to obtain a per-unit cost. A job-costing system allocates indirect costs to products. So job costing system as the costs are assigned to a distinct unit.

Typically businesses are unlikely to use work in progress with job order costing. Identify the seven steps in job costing. How does job costing system differ from process costing.

I will also build on this example to show you how the choices we make in the costing process affect the numbers reported in financial statements. Because the products and services are distinct job-costing systems accumulate costs separately for each product or service. What is the benefit of creating more than one manufacturing overhead cost pool.

So here what is their difference uh in a job casting system. 103 underallocated indirect costs p. A Costs are assigned to production runs and the number of units for which costs are averaged b Orders are taken and the number of units in the orders c Product profitability is determined and compared with planned costs.

Expert Answer Job Costing System Process Costing System 1 Job costing system is mainly used in companies where order have to be competed based on specific requests Process costing system is used in industries who are engaged in manufacture of large amounts of prod. A process-costing system assigns costs to masses of similar units. In job costing production is customized while it is standardized in process costing.

A process-costing system assigns costs to distinct units. The cost estimates for one particular job are as follows.

Acc 550 Cost Accounting Module 2 1 Discussion Job Costing Process Costing Or Operation Costing Cost Accounting Accounting Job

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com Managerial Accounting Accounting Education Accounting

Managerial Accounting Process Cossting Accounting Process Managerial Accounting Accounting Education

Tsedenya Gebreyesus In This Video He Explains And Goes Into Details About The Differences Of Job Order Costing And Process Costing He Job Relatable Process

Describes Job Order Costing Accounting Basics Managerial Accounting Information And Communications Technology

Udemy 100 Free Process Costing System Cost Accounting Managerial Accounting Cost Accounting Managerial Accounting Accounting Process

Amani Benn This Is A Diagram That Shows The Order We Follow When Using The Process Costing System I Am A Visual Learner So Diagrams Help Me Memorize Key Infor

Difference Between Cost Accounting Workforce Business Process Management

Pmp Study Note Study Notes Project Management Templates Program Management

This Video Helped Further Explain The Differences Between Financial And Managerial Accounting This Also Helpe Cost Accounting Accounting Managerial Accounting

Savannah Brown This Video Gives A Short Review Of Process Costing As Well As Giving An Explanation Of Some Of The Differenc Cost Accounting Accounting System

Ira Kulkarni This Video Explains The Difference Between Product Cost And Period Cost With Examples It Also Goes Over Eac Visual Learners Period How To Split

Process Costing Google Search Cost Accounting Accounting Classes Accounting Education

Which Of The Following Would Be Accounted For Using A Job Order Cost System In 2022 Accounting Job System

Cost Accounting Ca Is A Formal System Of Accounting For Costs In The Books Of Accounts By Means Of Wh Cost Accounting Accounting And Finance Financial Analysis

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Student

Job Order Costing Chapter 3 Chapter 3 Job Order Costing Ppt Download Inventory Accounting Cost Sheet Cost Of Goods Sold

Xiaoqian Chen This Picture Describes The Job Order Cost Flow Process That Related To Chapter 17 The Job Order Costing System I Think It Helps Us To Easier Un

Mario Armendariz This Pin Helps Explain The Difference Between The Job Costing And Process Costing Systems I Found This Helpful Because It Job System Process

Comments

Post a Comment